401k loan repayment calculator biweekly

401k Loan Calculator. Thinking about taking a loan from your employer plan.

Bi Weekly Loan Repayment Calculator

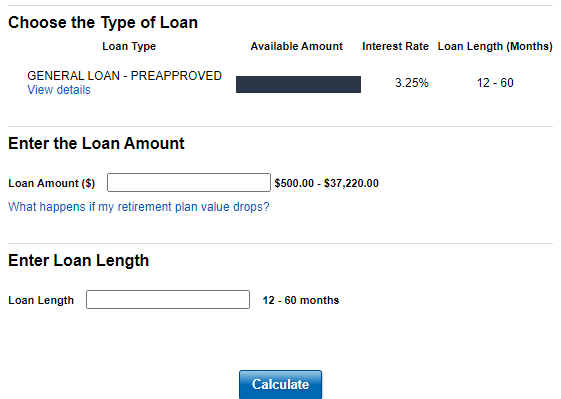

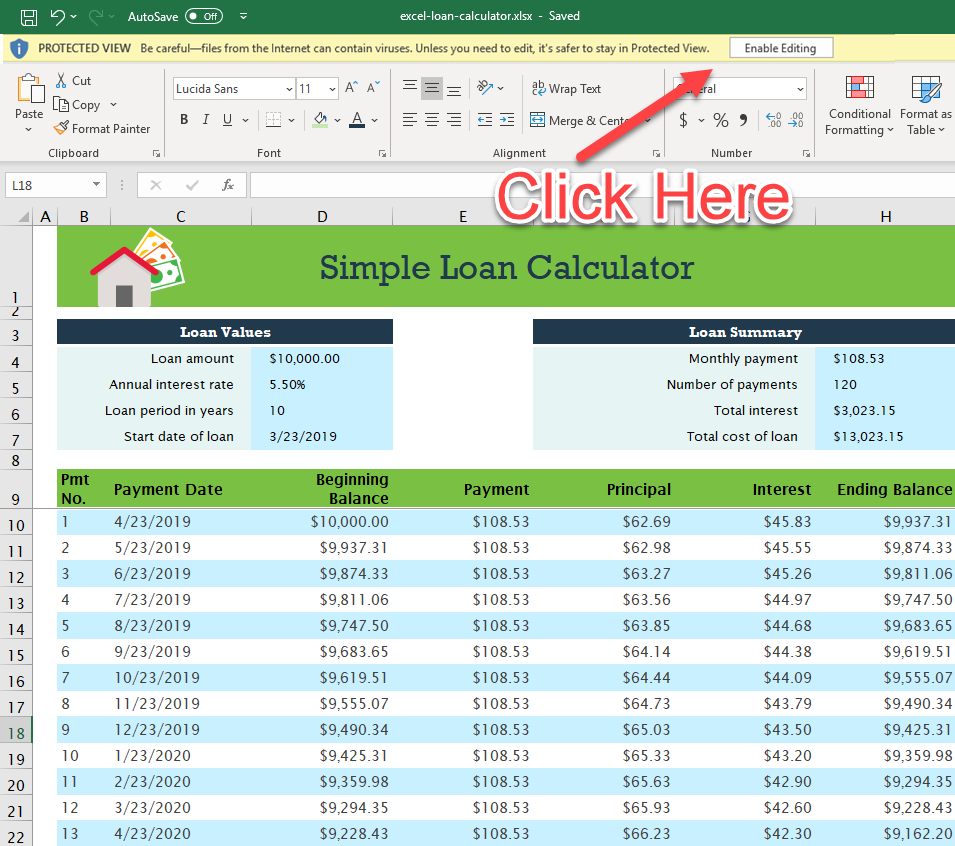

Amortization Schedule and Loan Payments Instructions for using the Solo 401k Loan Calculator.

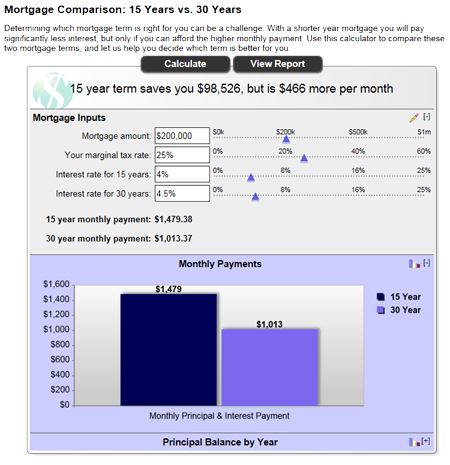

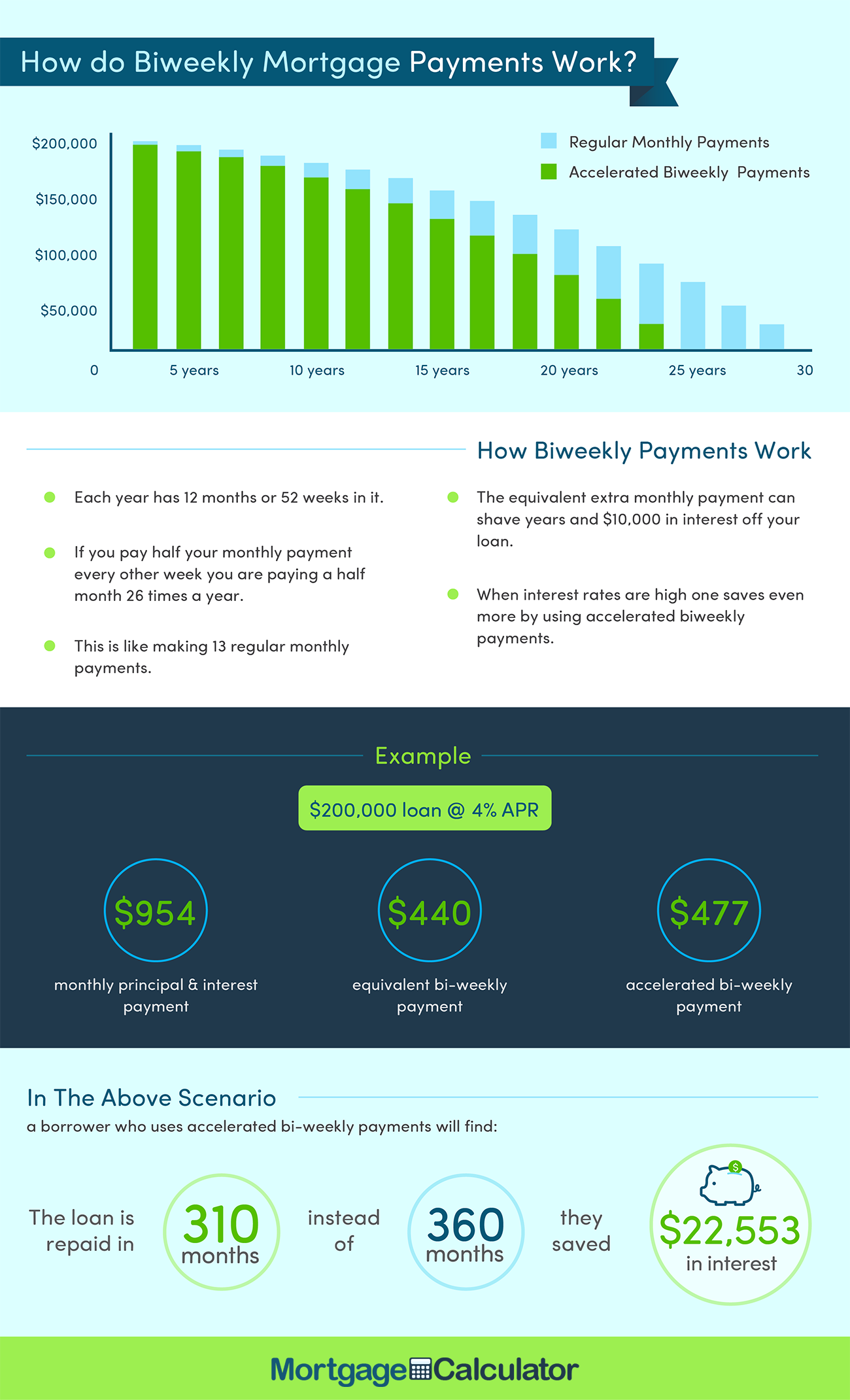

. You can then examine your principal balances by payment the. Secondly biweekly payments for a whole year will equal 26 yearly payments because there are 52 weeks in a year. This calculator will help you to compare the costs between a loan that is paid off on a bi-weekly payment basis and a loan that is paid off on a monthly basis.

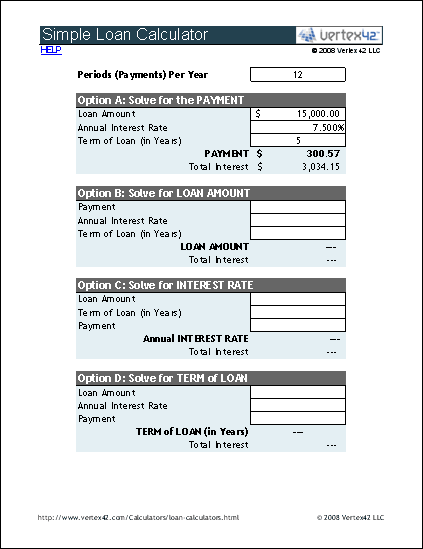

Select the month day and year of the date of the first payment. Principal enter the loan amount Terms enter number of years no more than 5 Interest. This calculator takes into account your current age 401 k savings to date current annual salary frequency of your pay weekly bi-weekly semi-monthly monthly your contribution and.

Want to Learn More. Biweekly Auto Loan Calculator. Discover AARPs Helpful Resources For Budgeting Saving And Investing Money.

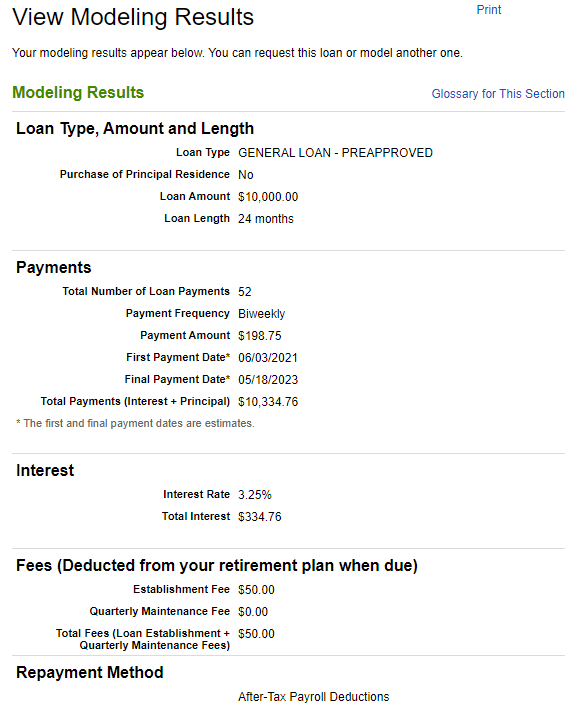

Before you do you should check out the true costs of such a loan with this calculator. This is equivalent to making 13 monthly payments a year. Best Online Brokers for Stocks.

Then download our free tools. Ad Use The Credit Card Pay Off Calculator To See What It Will Take To Pay Off Your Balance. Enter the term of the loan in the number of years.

Use this calculator to determine your payment or loan amount for different payment frequencies. Enter the annual interest rate of the biweekly loan. You can use this for any type of.

Use our 401k Loan Calculator to determine the true cost of the loan. Simply enter the principal balance owed on your car your. This tool calculates what your auto payment will be on an accelerated bi-weekly schedule.

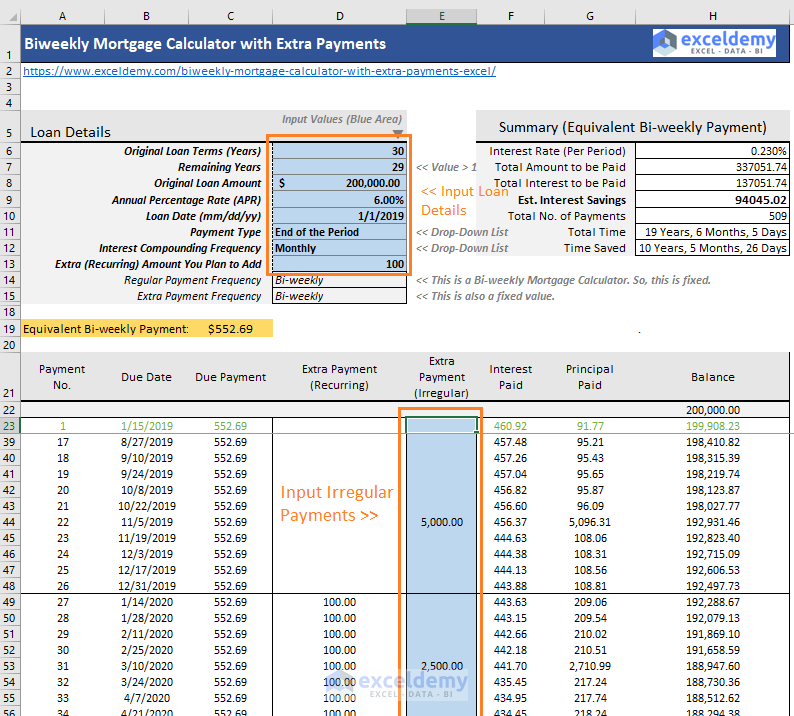

The Leave it In option will compound at 67 each month as thats 112 of the 8 annual returns while the 401K loan is also compounding at that rate but only for the amount. Best Ways to Invest 30K. Or if you prefer enter the monthly amount you can afford and the calculator will determine a corresponding loan amount.

You can make payments weekly biweekly semimonthly monthly bimonthly quarterly. Best Brokers for Low Fees. Borrowing from a 401 k Thinking of taking a loan from your 401 k plan.

900 1800 2700 3600 1883 3322 Plan Loan Alternative Loan Foregone investment return Total interest over the term of the loan.

Biweekly Loan Calculator

Auto Loan Calculator Free Auto Loan Payment Calculator For Excel

Financial Calculators Service2client S Website Tools

401k Loan Calculator 401k Loan Repayment Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Use This Free 401k Loan Calculator To See If A 401k Loan Is Right For You

Bi Weekly Loan Repayment Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Use This Free 401k Loan Calculator To See If A 401k Loan Is Right For You

Bi Weekly Loan Calculator With Payment Frequency Cost Comparison

Download Microsoft Excel Simple Loan Calculator Spreadsheet Xlsx Excel Basic Loan Amortization Schedule Template

Extra Payment Mortgage Calculator For Excel

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Loan Calculator Free Simple Loan Calculator For Excel

Use This Free 401k Loan Calculator To See If A 401k Loan Is Right For You

401k Loan Calculator 401k Loan Repayment Calculator